Source: Patrick Wellham

The identity of the most financially effective, most ruthlessly efficient British university is clear: Swansea Metropolitan University. Its operating surplus reached a hefty 20.5 per cent of income in 2011-12. On that score, Swansea Met leaves venerable counterparts such as the University of Oxford - with its 4.4 per cent surplus - trailing behind, like Mo Farah gliding to victory in a race against wheezing, flabby members of the House of Lords.

This is stretching things, of course, as operating surplus is only one of many measures of financial strength. Nevertheless, Swansea Met’s financial performance, in its last year of independent accounting prior to its recent merger with the University of Wales Trinity Saint David, may offer some lessons for the sector.

The key is really to put as much effort into our cost base as into our income bases. It’s an approach that’s not that common in the sector

According to David Warner, the former Swansea Met vice-chancellor whose academic specialism is higher education management, the university’s long- ingrained culture of “efficiency and effectiveness” was built on a foundation of exacting cost control. Staff work to their maximum capabilities thanks to relatively high pay and job security, while senior management sets an example through pay restraint, he believes.

Warner was the lowest-paid vice-chancellor of any UK university in 2010-11, with a salary (including benefits) of £154,000. “In a culture of cost control, if I were to be one of the highest paid vice-chancellors in the UK, it would be a little bit difficult to keep such a culture,” he says.

But while Swansea Met’s surplus was healthy, the sector-wide financial picture gives a few causes for concern, to judge by figures on the UK sector’s 2011-12 finances compiled for Times Higher Education by accountancy firm Grant Thornton.

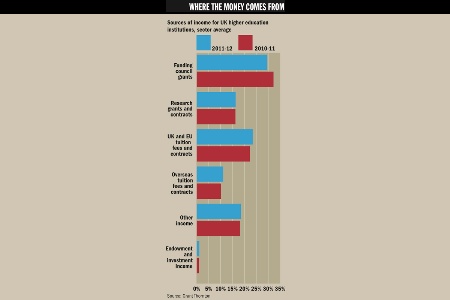

The UK sector’s income grew from £.4 billion to £.7 billion, but this was a fall in real terms: a below-inflation increase of about 1 per cent. The 2011-12 period was one in which the English sector saw “the beginning of the grant cuts without the opportunity to replace that income with higher fees”, notes Andrew McConnell, chair of the British Universities Finance Directors Group (BUFDG).

The sector’s collective operating surplus fell, from 4.5 per cent of income to 4 per cent. David Barnes, partner and head of education at Grant Thornton, notes that the number of institutions returning a surplus of more than 3 per cent slipped to 97, down from 109 the previous year. That still sounds reasonably comfortable, but will it prove to be enough to cope with the events ahead?

And within the sector-wide figures is a story about the richest institutions, which tend to have more students from well-off backgrounds, taking a still greater share of wealth.

Barnes sees 2011-12 as “the third of three good years. Student numbers were pretty much at maximum level and universities had had the benefit of managing their cost base better over that period.” But he also says it was “probably the last of the good years - the year following is when student [numbers] are down across the sector”.

According to the Higher Education Funding Council for England, which published its own annual report on institutional finances last month, Financial Health of the Higher Education Sector, the real-terms fall in the English sector’s income was the first such drop since records began in 1994-95.

Small pay rises: false economy?

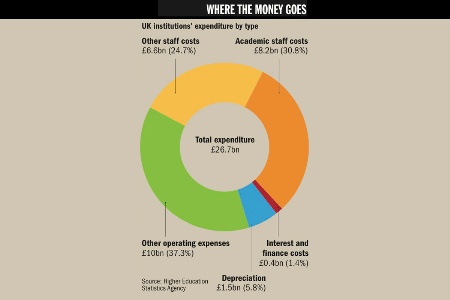

Financial data for the sector show that universities have borne down effectively on what is by far their biggest cost: staffing.

This could be good or bad news depending on your point of view.

Staff costs grew from £14.64 billion in 2010-11 to £14.68 billion in 2011- 12, a below-inflation rise of 0.3 per cent.

No English institution had staff costs of more than 64 per cent of income, the maximum threshold recommended by the Higher Education Funding Council for England. Only two institutions in the UK went above that line - the Royal Conservatoire of Scotland and the University of Abertay Dundee - compared with four the previous year.

The small £150 flat-rate national pay rise, negotiated by the Universities and Colleges Employers Association, was the latest in a series of below- inflation deals that will have been warmly welcomed by university managers, allowing them to keep costs in check.

David Barnes, partner in the education practice at accountancy firm Grant Thornton, says universities were also probably seeing the financial benefits “of restructuring that has gone through over the past few years”.

However, Tom Davies of Grant Thornton notes that some institutions seem to have taken “more of a hit on restructuring costs” in 2011-12 than others. Breaking down institutions into quartiles by income shows that the institutions most affected are those in the £50 million to £120 million income group, he says. Universities in this middle group may have been less quick to undertake restructuring, and sought to catch up last year, he suggests.

Barnes warns that pay could be an issue in the near future: “People get unhappy about not having pay increases.”

And based on its collation of institutional financial forecasts, Hefce says the English sector’s operating surplus is projected to plummet to just 1.6 per cent of income in 2012-13.

Why do operating surpluses matter? McConnell says that under the new, more competitive system of higher education funding, institutions need to build healthy surpluses so they can invest in improving their facilities.

“The requirement to invest in capital expenditure is increasing now, in a period where we don’t get the same level of capital grants we got in the past. To meet that expenditure, surpluses overall do need to be higher than they were before.” And looking at the 2011-12 sector average, surpluses “are not sufficient”, he adds.

Universities are acutely conscious of the “need to have our students having the best facilities that can possibly be delivered, particularly when they are paying higher fees”, McConnell explains.

In a more marketised system, with student places increasingly allocated on a competitive basis, universities will live and die by their ability to attract students.

McConnell says that at the moment “borrowings are increasing and liquidity is forecast to diminish. That really tells you we are not generating enough cash at the moment to meet that [capital] need.”

On the projected 1.6 per cent surplus for 2012-13 found by Hefce, McConnell argues that the sector has “a record of delivering stronger results than we [finance directors] forecast” and makes projections on a “very cautious basis”.

But he adds: “If the result was 1.6 per cent, that would be worrying.”

So which institutions were notable achievers at either end of the scale in financial terms? After Swansea Met, with the highest operating surplus, come Bishop Grosseteste University (15.7 per cent), the University of Huddersfield (15.4 per cent) and Liverpool Hope University (14.1 per cent).

How did Swansea Met achieve this? The key, says Warner, “is really to put as much effort into our cost base as into our income bases. It’s an approach that’s not that common in higher education institutions.”

High yield: overseas income rises

Once again, overseas fee income was by far the fastest-growing revenue stream for the UK higher education sector in 2011-12.

This source of revenue brought in £3 billion to the sector, up from £2.8 billion the previous year.

Overseas tuition fees now amount to 11 per cent of income.

However, some institutions have an even greater reliance on non-European Union student income - and this source of funding is potentially vulnerable, given the impact of the government’s visa policy on student recruitment.

The Higher Education Funding Council for England notes in its report on sector finances, Financial Health of the Higher Education Sector: 2011-12 Financial Results and 2012-13 Forecasts, that the number of institutions reporting greater reliance on overseas income is growing. It notes “10 institutions reporting overseas income of over 20 per cent of total income in 2011-12, compared with four institutions in 2008-09”.

And Hefce states that universities in England are revising their growth forecasts for 2012-13 downwards.

The latest figures suggest a rise of 6.8 per cent in overseas income compared with the 9.9 per cent increase predicted in June 2012.

This “may suggest that some institutions have responded to concerns about the impact of the latest changes in visa regulations on the overseas student market”, the report adds.

As part of the effort to “examine and continuously review every aspect of our cost base”, every six months, any two members of staff can exercise the right to check through and query any line of significant spending.

“My job and the director of finance’s job is to be able to justify that expenditure,” says Warner, who has taken up the role of senior provost at the institution in the wake of the merger.

Surpluses are needed for investment. We’ve got a strategy for what our surpluses need to be and what our investment needs are, and we’ve got mechanisms to deliver those surpluses

The relatively high pay of the university’s staff compared with others in the city, and the absence of compulsory redundancies, means that “people work harder”, says Warner. “It enables you to be more efficient.”

The institution’s surplus has been above 9 per cent of income every year since 2007-08. “This isn’t a blip…It is part of a planned programme aimed at delivering what we do as efficiently and effectively as possible.”

Swansea Met’s considerable surpluses have given it the ability to keep funding for teaching support “pretty high”, says Warner, and to invest in a number of new buildings, essential for a city-centre institution that is “landlocked” and must acquire property if it wishes to expand.

The BUFDG’s McConnell, who is also finance director at Huddersfield, says there is a “strong culture of financial awareness” at his own institution, and a realisation “that good surpluses are needed for investment. We’ve got a strategy for what our surpluses need to be and what our investment needs are, and we’ve got mechanisms here to make sure those surpluses are delivered.”

The list of the biggest university deficits is led by the University of Salford (6.6 per cent of income), the University of Reading (5.1 per cent) and Queen Mary, University of London (3.2 per cent). The University of Wales had a 35 per cent deficit, but it is something of a unique case, given that the institution is gradually ceasing to function as an independent entity.

A spokesman for Salford said the institution expects “that our operating costs will return to surplus in 2012-13”.

He cited “an under-recruitment relative to budget of home and, in particular, overseas postgraduate students, and an increase of £11.3 million in the asset depreciation charge following the decision to revise our property portfolio” as reasons for the deficit.

A Reading spokesman said its operating deficit was planned and “has funded, among other things, a major academic investment programme in the university’s areas of core research strength”.

Behind the data: tables explained

The table gives data for the financial year ended 31 July 2012. It includes all higher education institutions listed on the funding councils’ websites. All decimal figures are rounded to the nearest whole number.

The following institutions’ accounts were not available at the time the data were compiled: Glyndwr University, Heythrop College, University of Wales Trinity Saint David, Stranmillis University College and the University of Glamorgan.

Net surplus/deficit: the difference between income and expenditure. It does not take into account any profit or loss made on the disposal of assets. Deficits are shown in parentheses.

Funding council grants: all Higher Education Funding Council for England/Higher Education Funding Council for Wales/Scottish Funding Council grants as well as those from other public funding bodies such as the Teaching Agency.

Research grants and contracts: all research income from all sources except Hefce/HEFCW/SFC research grants.

Tuition fees and contracts: tuition fees from UK and European Union students, plus other teaching income relating to education contracts, short courses and such.

Overseas fees: tuition fees received from full-time and part-time students outside the UK and EU. Where no figure is given, overseas fees were not differentiated in the accounts.

Other income: from all other sources not previously categorised.

Total staff costs: total wages and salaries, including benefits, social security costs and pension contributions.

Interest paid: includes interest on pension liabilities. Institutions with zero borrowing may still have large interest payments.

n/a: not included in the survey last year.

* figure not published in accounts

He added that although there was an operating deficit, an overall surplus was attained thanks to the university’s “underpinning and robust financial strength…based on its land and other investments which are amongst the strongest in the sector”.

A Queen Mary spokeswoman said its deficit “was not unforeseen. We made a number of commitments to improving the student experience at Queen Mary including, but not limited to, significant investment in the upgrade of our IT infrastructure and a new students’ centre…We are predicting a return to surplus this financial year.”

Beyond the important matter of highlighting how individual universities are faring, the overview of the sector’s health has a bigger impact, informing governments responsible for deciding how much money to put in or, as is more likely, to take out.

In England, Hefce fears that the still-healthy financial state of universities in 2011-12 could be taken by the Treasury as evidence that universities can afford to feel some more pain in the 2015-16 spending review, to be announced in June.

Speaking at a conference in February, Graeme Reid, head of research funding at the Department for Business, Innovation and Skills, said it was time for universities to show that they were making efficiency savings, as the sector was viewed by some as “well-funded” and “resistant to change”.

“The term ‘awash with cash’ has reached my desk several times recently,” he told Universities UK’s Efficiency in Higher Education conference, in a remark that may have indicated the prevailing view at the Treasury.

McConnell, speaking in his BUFDG capacity, strongly takes issue with this perception.

“Being ‘awash with cash’ implies more cash than universities need to have,” he says. Such a view is “taking a snapshot of the cash side of the balance sheet - it doesn’t take any account of all the sector’s liabilities in terms of borrowings”, he argues.

As of 31 July 2012, the English sector had £8.1 billion in liquid funds, but against that was £6.1 billion in debt, says McConnell.

The £2 billion difference is “less than one month’s expenditure” for the sector, he adds. “That is quite a small cushion.”

Lion’s share goes to Russell Group

Russell Group universities take a disproportionate chunk of the sector’s wealth, accounting for about half of the total income and assets of UK higher education institutions.

The 24 members of the group of large research-intensive universities make up just 15 per cent of the 158 UK higher education institutions in our survey.

Yet in 2011-12, Russell Group institutions controlled about £18 billion of the sector’s £34.5 billion assets, a 52 per cent share.

And Russell Group universities took £12.6 billion of the sector’s £.7 billion income, a 45 per cent share. That was thanks in part to their dominance of research income, where they took £3.3 billion of the sector’s £4.5 billion total, a 73 per cent share.

Russell Group dominance is likely to increase in the future, with its institutions effectively operating outside student number controls as a result of the ABB system, and they have been rewarded in their calls for greater research concentration.

The richest institution, the University of Cambridge, has £3 billion in assets. That means Cambridge has 418 times the wealth of the poorest university, the University of the Highlands and Islands, which has assets worth just £7.2 million.

Given the current “volatility of income streams, unpredictability of [student] demand and…increasing competition”, McConnell continues, “you would expect a sensible finance director to create some sort of position of strength to be able to meet those uncertainties. That is what we have done - and that doesn’t mean it is excessive.”

But McConnell agrees that a key part of the strategy for the future must be to “look at ways of being more efficient and modernising”. He highlights the 2011 Universities UK report Efficiency and Effectiveness in Higher Education, which was produced by a committee led by Ian Diamond, vice-chancellor of the University of Aberdeen.

The report recommends that “partnership approaches to outsourcing” be “considered as a normal part of [universities’] strategic planning”.

On shared services, McConnell says that he is “hearing of more schemes being considered” following the government’s announcement of a VAT exemption for services shared between VAT-exempt bodies, such as universities.

But university staff might prefer to hear the kind of talk offered by Warner, who says of the absence of compulsory redundancies at Swansea Met: “It massively increases morale. And high morale gives you your highest level of output.”

Warner plans to return to writing on higher education management in the next phase of his career, drawing on his experiences at Swansea Met. “Perhaps there is a little bit of expertise about efficiency and effectiveness which could assist the sector and other institutions,” he says.

With storm clouds of financial volatility and uncertainty overhead, any advice about how to build some shelter may well be gratefully received.