UK higher education’s biggest pension scheme plans to significantly increase the contributions demanded from universities and staff, even though a review of the fund’s deficit by an expert panel is yet to be completed.

The Universities Superannuation Scheme said that, subject to consultation, employee contributions – currently set at 8 per cent of salary – will rise to 8.8 per cent in April 2019. Further rises to 10.4 per cent in October 2019 and 11.7 per cent in April 2020 are planned.

Employer contributions, currently 18 per cent of payroll, are set to rise to 19.5 per cent in April 2019, 22.5 per cent in October 2019, and 24.9 per cent in April 2020.

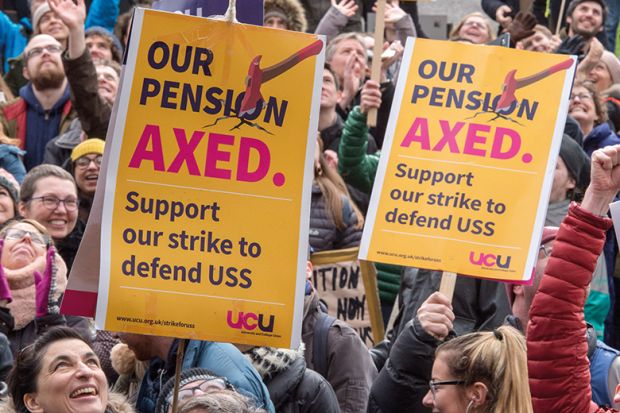

The move, announced on 25 July, comes ahead of review of the current valuation of the USS and its deficit by an expert panel jointly nominated by Universities UK and the University and College Union. This was set up in April following 14 days of strike action at 65 universities over UUK’s proposal – now dropped – to end guaranteed payments to retirees and instead link their income to the performance of investments.

But USS said that action was needed now to address the deficit, which it estimates to be £7.5 billion, and that the legal deadline for completing the valuation process had already passed.

Bill Galvin, the fund’s chief executive, told Times Higher Education that it had been a “difficult” decision to make the increases but that the scheme was “out of time”. The increases would “require substantial adjustments” on the part of both employers and staff, he acknowledged.

“We hope that the joint expert panel will result in stakeholders coming to the conclusion that they can agree on how to deal with the challenges faced by the scheme but we need to press on in respect of the valuation that had already been done in March 2017,” Mr Galvin said.

“We have introduced the increases in contributions in a phased manner so that, if the joint expert panel comes up with a conclusion that both stakeholders can sign up to, that could be implemented.”

Mr Galvin added: “We would hope that we would avoid the most significant of the later contribution increases.”

The joint expert panel is due to submit an initial report in September.

USS’ announcement coincided with the release of its annual report, which indicates that the scheme’s deficit has reduced over the past 12 months. On one measure, which uses similar assumptions to the last full valuation, conducted in 2014, the deficit reduced from £12.6 billion to £12.1 billion in the year to April 2018.

On another measure, which relies heavily on assessments of the likely value of corporate bonds, the estimated deficit more than halved, from £17.5 billion to £8.4 billion.

A UCU spokesman said that the joint expert panel would look closely at these issues. “Our priority remains to resolve the dispute as promptly as possible with a deal that protects members’ pensions and we hope that the report of the JEP will provide the platform for doing this,” he said.

A UUK spokesman said that the organisation was committed to reaching an agreement with UCU and that “we hope this agreement will allow the higher levels of contribution increases proposed to be avoided”.

“The increases in contributions being proposed will be challenging for both employers and scheme members,” the spokesman said. “This temporary fix will lead to difficult decisions at many institutions over financial priorities.”

The USS report also reveals that Mr Galvin’s salary and benefits rose by 12.2 per cent during 2017-18, from £566,000 to £635,000. The increase included payments under a long-term incentive plan.

Register to continue

Why register?

- Registration is free and only takes a moment

- Once registered, you can read 3 articles a month

- Sign up for our newsletter

Subscribe

Or subscribe for unlimited access to:

- Unlimited access to news, views, insights & reviews

- Digital editions

- Digital access to THE’s university and college rankings analysis

Already registered or a current subscriber? Login