Donald Trump’s election has left investors betting that the trillion-dollar US federal student loan system could be shifted back to banks, with a leading Democrat putting his pick as education secretary under pressure on the issue.

Mr Trump, who will be inaugurated as president on 20 January, comes to power with his campaign co-chair having suggested prior to the election that student lending should be “marketplace and market driven”. The Republicans also said in their 2016 platform that “the federal government should not be in the business of originating student loans”, prompting suggestions that the Trump administration or the Republican Congress could make efforts to reverse a key Barack Obama reform and shift the provision of loans away from the federal government and back to banks.

Critics fear that would require expensive government subsidies for banks, as well as generating concerns about the raising of financial barriers for students.

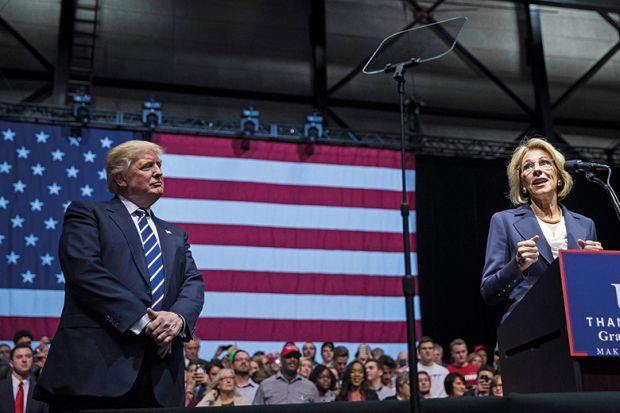

Betsy DeVos, a billionaire charter school and school voucher advocate who is Mr Trump’s nominee as education secretary, has been attacked for her “seemingly non-existent record on higher education” by Democratic senator Elizabeth Warren.

In a letter to Ms DeVos on 9 January, former Harvard Law School professor Senator Warren pledged to press her on loans at the Senate committee that will consider her nomination.

She raised a number of questions for Ms DeVos on this: “Do you believe [that] there is statutory authority to re-privatise the student loan programme?...If not, will you oppose efforts by Wall Street lobbyists to pass legislation that privatises the student loan programme?”

Shares in student loan providers such as Sallie Mae have surged since the election.

Republicans have attacked the very existence of the US Department of Education, which administers loans and began operating only in 1980. Removing or cutting back on loans provision would strip it of a major part of its responsibilities, although the department also administers Pell Grants for poorer students.

During his campaign, Mr Trump said that he wanted to make loans cheaper for students, which many say is inconsistent with a return of loans to banks.

Ben Miller, senior director for post-secondary education at the Centre for American Progress thinktank, said that a return of loans to banks would be “literally a government giveaway to banks over students” in terms of the subsidies required.

Mr Miller, formerly a senior policy adviser in the Department of Education, said that the federal government loans out “roughly $100 billion (£82 billion) a year...There is no way the private market would pick up all that slack. Would they go and lend to kids at Harvard? Sure. But they are not going to lend to kids who go to...schools that are OK schools but are not the most prestigious ones in the country.”

He added that while it was easy to “bluster” on such policy plans, “it’s another thing to be on the hook for when college enrolment suddenly plummets by millions of people”, making a wholesale return of loans to banks unlikely.

Barmak Nassirian, director of federal relations and policy analysis at the American Association of State Colleges and Universities, said that “banks and the remnants of the old student loan system” have been “somewhat effective in getting their rhetoric about the alleged virtues of the old arrangement into the GOP [Republican] playbook, but the more than $100 billion federal cost of reviving bank-based lending makes it well-nigh impossible”.

Register to continue

Why register?

- Registration is free and only takes a moment

- Once registered, you can read 3 articles a month

- Sign up for our newsletter

Subscribe

Or subscribe for unlimited access to:

- Unlimited access to news, views, insights & reviews

- Digital editions

- Digital access to THE’s university and college rankings analysis

Already registered or a current subscriber? Login